Global Payments Made Simple: Zero Cost, Maximum Reach.

Simplifying Global Payments

for PSP

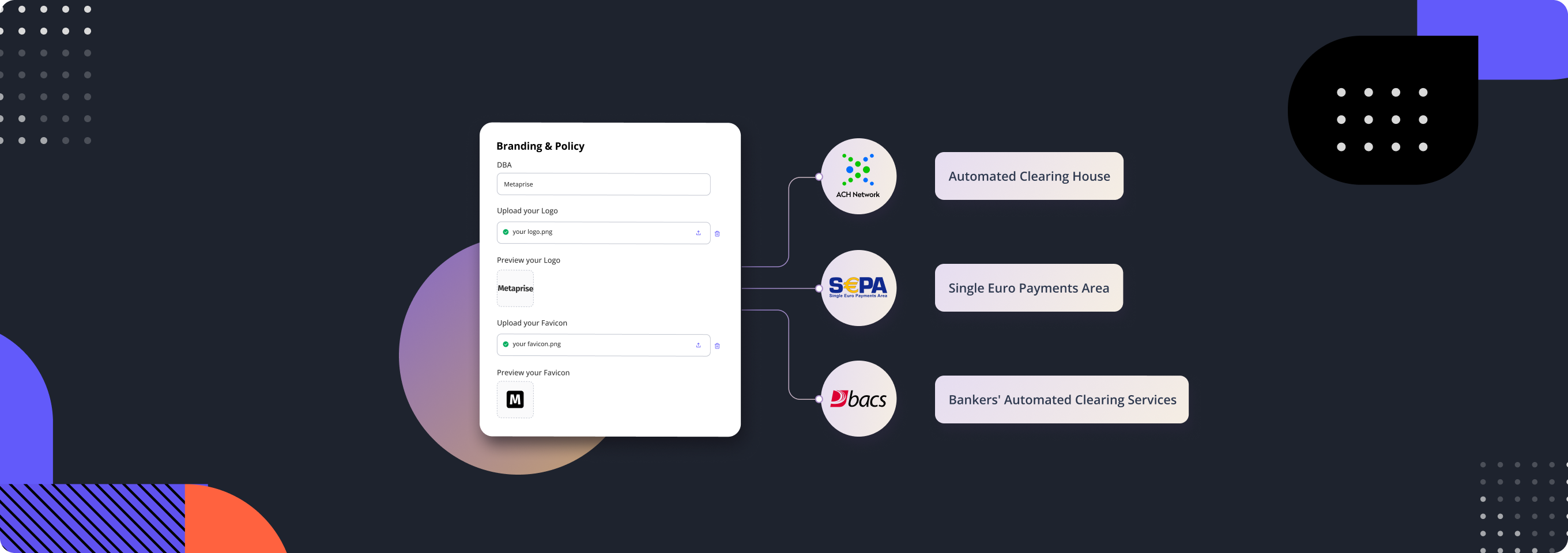

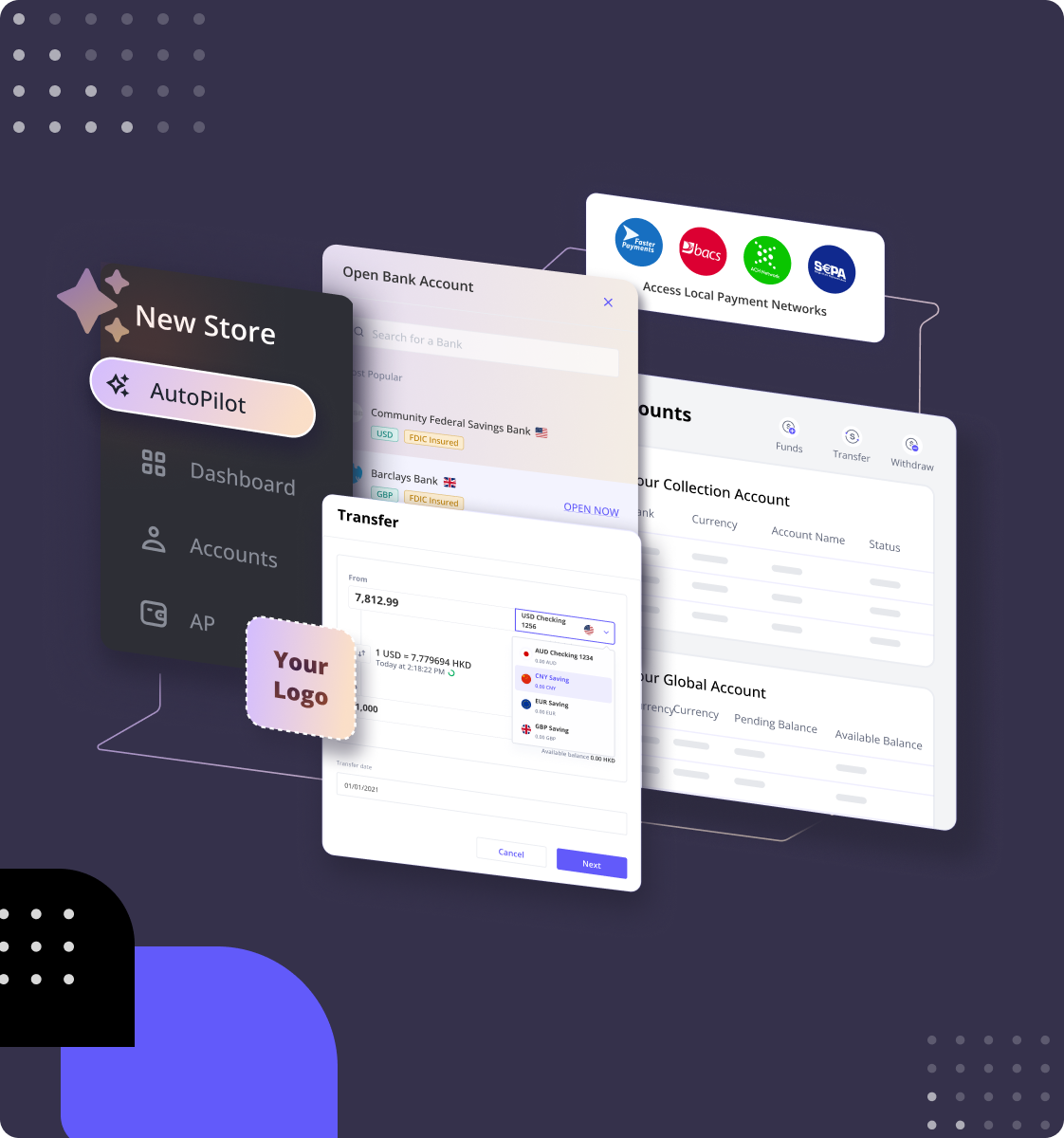

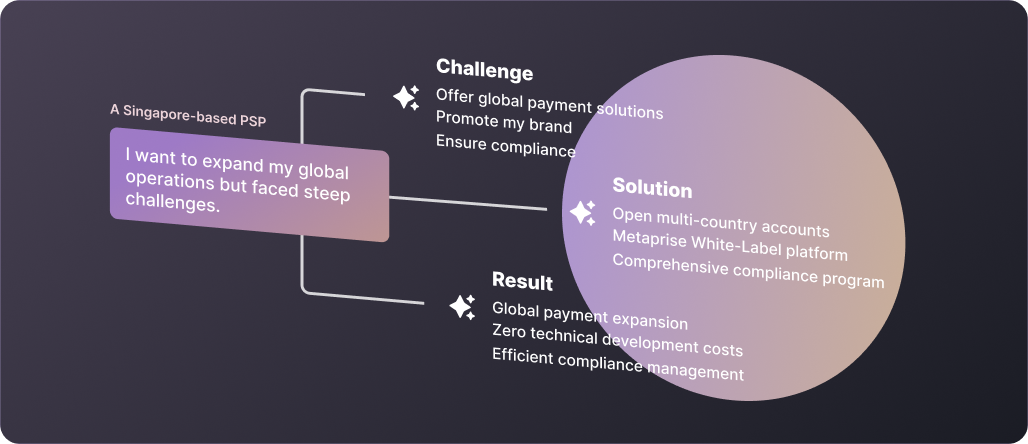

Our solution is specifically designed to offer payment service providers the most streamlined global receivables platform. Metaprise empowers providers to manage global collections with ease by offering comprehensive solutions that eliminate technical development, compliance, and banking partnership challenges. Through our white-label solution, payment providers can launch fully customizable global receivables systems with zero upfront costs, bypassing the need for expensive licenses or lengthy integrations. We handle the complexities of technology, business compliance, and bank collaborations, allowing providers to focus solely on growing their business.